Expenses – Reframing Spending to Serve My Financial Goals

Not All Spending Is Created Equal

In my last blog post, I talked about how budgeting by pay period changed everything for me. It gave me clarity, control, and a system I could actually stick with for the long haul. But that shift didn’t just impact how I plan—it changed how I view my spending entirely.

See, for the longest time, I treated expenses like just another column in a spreadsheet. A line item. A number to subtract. But over time, I realized something: every expense tells a story.

Where your money goes says a lot about what you value, what you struggle with, and what you’re working toward. Some expenses support your goals. Others sabotage them. And many just float in the middle, draining cash without a second thought.

This post is about how I’ve learned to look at expenses differently—through a lens that’s emotional, intentional, and focused on progress.

Let’s break it down.

What You Spend On Shows What You Value

If you really want to understand your financial habits, you need to really examine where your money goes. Not just the total—but the why behind each swipe. What I’ve found over time is that every expense comes with an emotion, a story, or a trigger behind it. Not every swipe is bad though and that's the importance of examining each one. You can learn whether or not that expense is serving your goal or not.

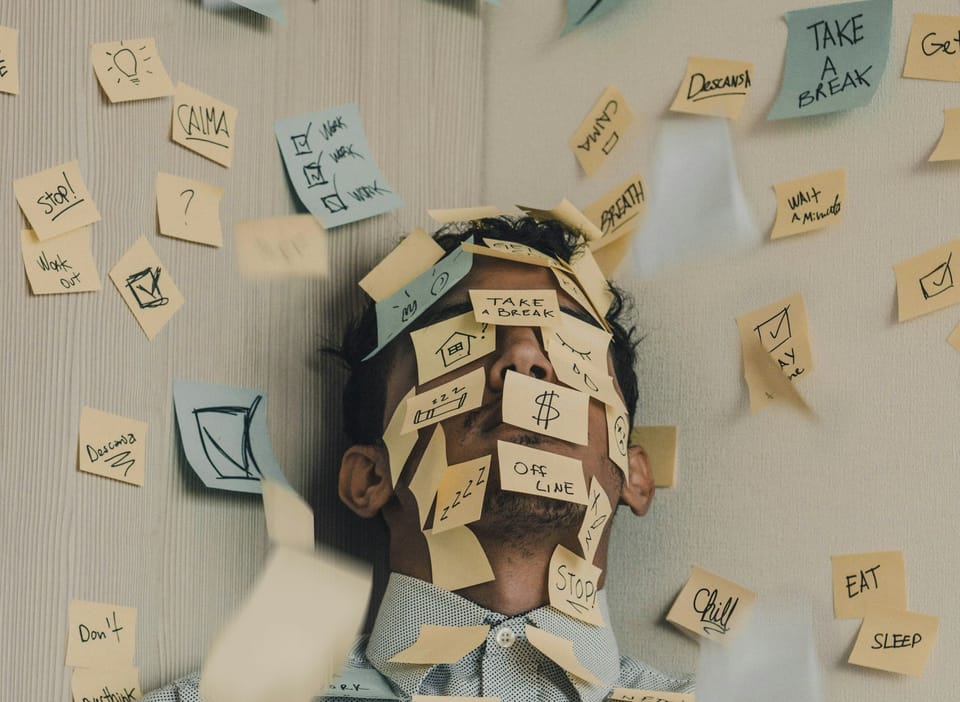

Stressful week? That’s when I went out to dinner three nights in a row. Got a bonus? Suddenly, it felt like I deserved to treat myself. Convenience, boredom, stress, ego—these are some of the most expensive emotions we carry.

Once I started paying attention to my expenses through that lens, I saw patterns. It wasn’t about beating myself up—it was about getting honest. As long as you're honest about why that expense exists you can make a solid decision on whether or not it stays and serves you. Netflix might not mean anything to most people but to you watching movies with your kids every Friday night makes that monthly withdrawal worth every penny.

Then came the next question: Do my expenses reflect my values? That’s where the real shift happened. I started funneling more money into things that moved me forward (extra debt payments, gym membership, tools for my side hustle) and less into things that gave me a temporary high.

Many people call this Values-Based Spending—I just call it spending with intention. Because if your money doesn’t align with your values, it’s probably working against them.

Simplify Your View: Needs vs Wants vs Goals

One of the biggest mistakes I used to make was overcomplicating my expenses. I’d break everything into a dozen micro-categories, thinking more detail meant more control. But instead of gaining clarity, I created confusion, frustration and eventually, avoidance.

What helped me finally get on track was simplifying how I view spending. Now I break everything into three buckets:

- Essential expenses – the must-pays: rent, groceries, car payment, minimum debt payments

- Discretionary spending – the wants: restaurants, streaming services, lifestyle upgrades

- Goal-directed spending – the intentional stuff: extra debt payments, savings, investing, or side hustle tools

That’s it.

I've seen past (credit cards, auto loan, etc), present (daily expenses not from the past), and future (extra debt payments, savings, investing, etc). I've seen "Have To", "Get To", "Want To" whatever makes sense to you do it, just keep it simple.

This simplified framework keeps me from getting lost in the weeds. I’m no longer asking, "Did I overspend on food delivery vs groceries this week?" Instead, I’m asking, "Did I give enough to my goals after covering my needs?"

This also makes tracking in my Payday Power Plan sheet more impactful. Whatever money I have left over (Payday Power) I can easily see what category my money is going to and where I can put a little extra.

Remember: the goal isn’t to obsess over every dollar. It’s to make sure your money is flowing in the direction you want your life to go.

Mental Gymnastics

Let’s talk about something that quietly wrecks a lot of budgets: mental accounting.

Mental accounting is when you treat money differently based on where it came from. A tax refund feels like "free money" so you blow it. A paycheck feels serious, so you allocate it carefully. Found $100 on the street? That’s "fun" money.

But here’s the truth: all money is real money. And if you want to stay on track financially, you’ve got to stop assigning emotion to the source.

For me, that meant training myself to treat all income—whether it was a bonus, refund, side hustle income, or my regular paycheck—as part of the same system: my cash flow plan.

Once I removed the mental labels I avoided a ton of missteps. No more impulse buys just because the money felt extra. No more saving the “real discipline” for my paycheck alone.

This mindset shift helps me stay consistent on my debt payoff journey. When you frame all money through your goals (not your emotions) you make better decisions. Period.

Expense Tracking as Self‑Awareness

One of the biggest mindset upgrades I’ve had around money is realizing that tracking expenses isn’t just about numbers—it’s about awareness.

I don’t track my spending monthly anymore. I track it by pay period. Why? Because when you review your expenses every two weeks, the choices are fresh. The context is current. It’s way easier to spot habits before they become financial leaks.

Over time, patterns started to emerge. I noticed how often I turned to food delivery when I felt burned out. I saw the sneaky subscriptions I wasn’t even using. I recognized boredom spending on stuff I didn’t need but bought just to get a dopamine hit.

But here’s the key: I didn’t shame myself for it. I just started noticing.

That’s the difference between logging your expenses and actually reflecting on them. Logging is data. Reflecting builds discipline and better decisions.

Each review became a chance to ask, “Is this serving me?” or “Would I choose this again?” or "Do I still want to keep paying for this?" And slowly but surely, I made better decisions. Not perfect ones—but better, more aligned ones.

Tracking my expenses this way has helped me become more intentional and more resilient. I’m not just managing money—I’m understanding my relationship with it.

Reframe Spending So It Serves You

Your expenses tell the story of your financial life. When you look at them honestly, simplify the way you group them, and reflect regularly—your money starts working for you, not against you.

This isn’t about guilt. It’s about alignment.

Are your expenses pushing you closer to your goals—or pulling you away from them?

If you want help tracking and categorizing your money with intention, grab my Payday Power Plan (PDF or Google Sheets).

And if you’ve spotted any patterns in your own spending—or built a system that works for you—I’d love to hear about it. We learn faster when we learn together.

I’m not debt-free yet—but how I spend and why I spend matters more than ever.

Cheers

Max