🏔️Monthly Debt Climb Recap – October 2025

$839.82 might not seem like a lot of debt payoff relative to my debt but I couldn't be happier with it. Great September! Time to show October who I am.

Credit Cards. The Tool That Can Make or Break You

Credit cards aren’t evil...but they’re not harmless either. Learn how they work, where people go wrong, and the rules I follow to make sure I never pay interest again. This could change how you use plastic forever. 💳🔥

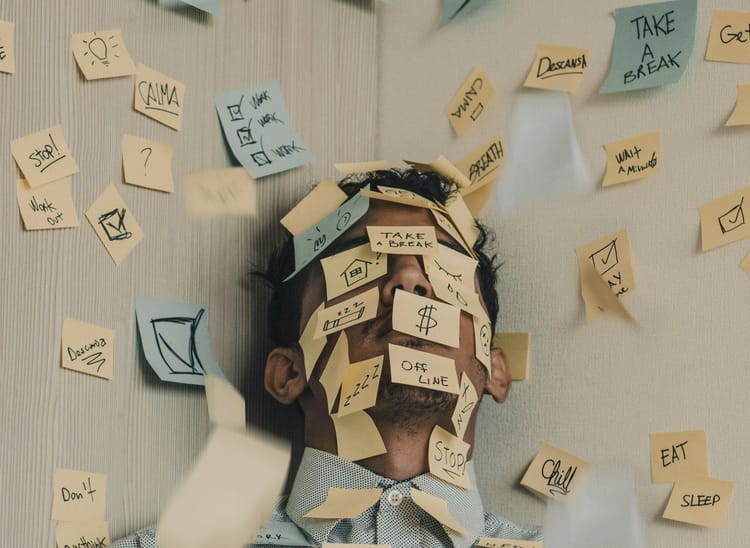

When Life Happens: How I Handle Financial Curveballs Without Derailing My Goals

Life doesn't care about your budget. Here's what I do when life happens and I think I'm financially ruined.

🏔️Monthly Debt Climb Recap – September 2025

September 2025 comes with relatively little debt progress but a ton of life enjoyment!

🏔️Monthly Debt Climb Recap – August 2025

3 months into my debt free journey! Here's the 1 August 2025 recap.

Expenses – Reframing Spending to Serve My Financial Goals

Your expenses aren’t just numbers—they tell the story of your values, habits, and goals. Learn how I simplified my spending, stopped feeling guilty, and started using every dollar with purpose. This might change how you see your money for good.

How I Budget – The Method That Finally Made Sense

Forget monthly forecasts. The most powerful way to budget is by focusing only on what bills are due and what impact you can make during your current pay period. That’s where real control, progress, and financial clarity begin.

HOW and WHO You Bank With Matters

Most people obsess over budgets and investments—but overlook where they bank. I break down why it matters, what works for me, and why it’s time to rethink who holds your money.

🏔️Monthly Debt Climb Recap – July 2025

The monthly debt free journey recap! July 2025

The Benefits of Having a Budget

TLDR: Having a budget is a MUST when working to get a hold of your finances. It gives you peace of mind, the ability to track progress towards your goals and plan for the future. You don't need much more reason than that to start a budget today.